How to Track Your Expenses

This post may contain affiliate links which means I make a commission if you shop through my links.

Disclosure Policy

One of the easiest ways to save money is to track your expenses.

Unfortunately, that can be hard to do. We spend money in so many different ways:

- cash

- credit card

- person to person – Paypal, Venmo, etc.

- the list goes on.

Getting monthly statements online makes it even harder.

Out of sight, out of mind.

So, what can you do to take back control of your budget?

The best way to track spending is honestly the method that you will stick with.

Recently, I have been using an unconventional paper planner in a vertical weekly layout to track personal expenses and it’s been working really well for me.

So, I wanted to share it with you.

How to Keep Track of Expenses

In my opinion there is ONE key component to keeping track of expenses.

It boils down to DAILY involvement with your spending.

Taking a few minutes at the end of each day to visit your online accounts and record your charges and cash out is very important.

If you get this snapshot on a daily basis you can make more informed purchasing decisions and less impulsive buys.

So – how do you do this? How do you get a big picture of your finances daily without spending a ton of time?

The Problem With Spreadsheets and Ledgers

People keep track of their expenses in many different ways.

Some use a personal expense tracker app, track spending in excel spreadsheets, or use some kind of an online or paper ledger.

I have tried all of these methods and none really work for me.

The problem is that seeing all my expenses in a list type view jumbles everything up in my mind.

Typically, you end up with a different spreadsheet or list for all of your different accounts.

Updating these on a daily basis is tedious and time consuming.

Instead of focusing on keeping track of my spending, I ended up focusing on data entry instead.

For some people, spreadsheets are great – but apparently my brain doesn’t work that way.

What I needed was a simple daily picture of my charges and my cash out.

My Solution Is a Paper Planner In a Vertical Weekly Layout

If you have seen any of the other posts on my blog, you may have noticed that I am a big fan of the

I use one of these to keep track of my calendar and schedule.

So one day, a lightbulb went off in my head and I got the idea that maybe I could use one of these planners to track my expenses as well.

You don’t necessarily need an

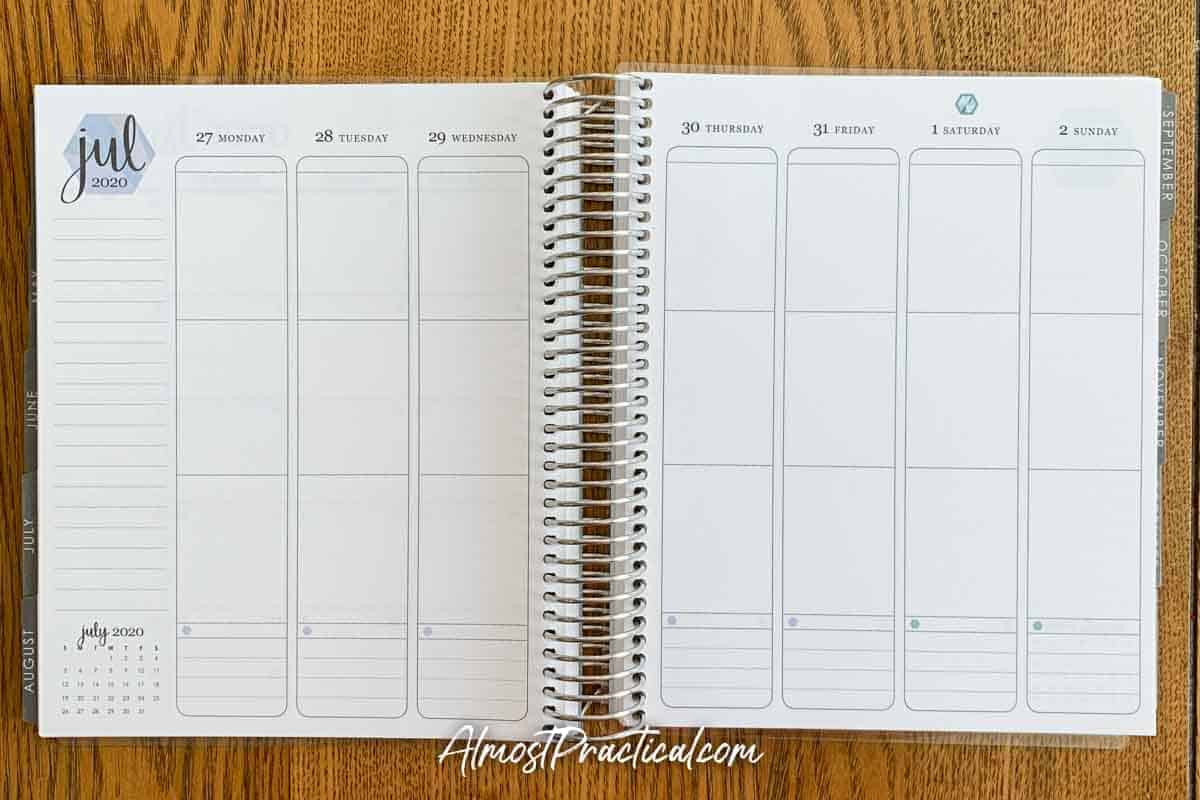

This is a photo of how the weekly vertical layout looks:

Let me try to explain how I use this.

How You Spend Your Money

As I mentioned earlier, there are many different ways that we spend money – credit cards, cash, etc.

However, I try to use just a few of these daily. For the most part I use

- one primary credit card for most of my charges,

- one checking account for most of my payments and withdrawals,

- and then there is actual cash spending for little things here and there.

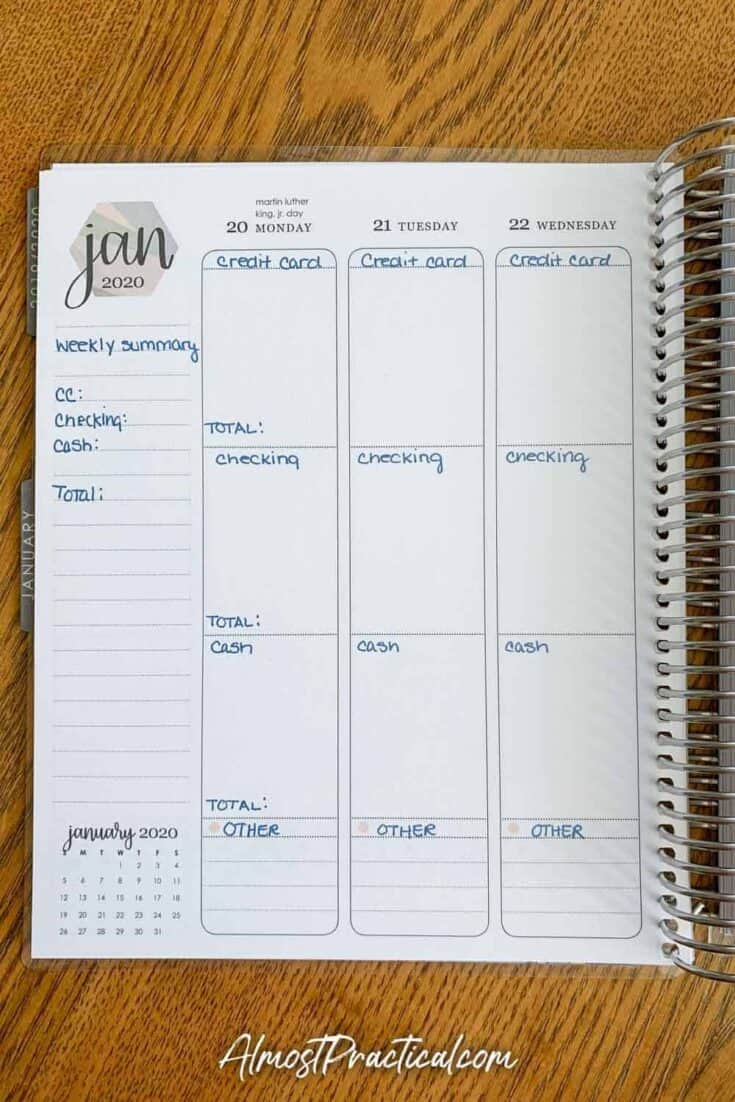

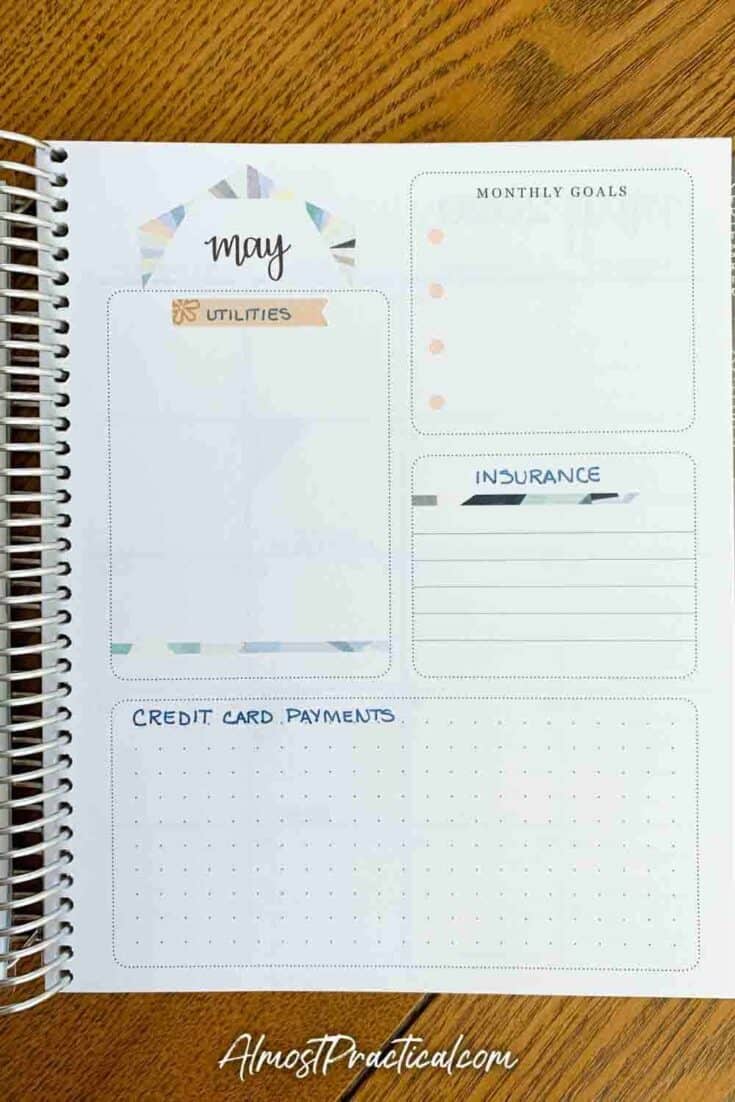

The

I use each section to track personal expenses daily for each account where money flows out.

So, I use the top third to record daily charges on my primary credit card, the middle section to record money that goes in or out of my checking account, and the bottom section for cash expenses.

At the bottom of each column in the

I use this section to record expenses on some of my other accounts that I don’t use as often – things like charges to a store credit card, or a person to person transfer, etc.

Getting Your Spending Snapshot

To track my daily personal expenses, I simply add up the amounts in each section.

The bonus, is that I use the left hand lined column to create a quick weekly summary using the amounts that I recorded on each day.

And in the

The Mechanics of Recording Your Personal Expenses

To stay involved with this process on a daily basis, all you need to do is take a few minutes at the end of each day to record your daily spending.

You can collect receipts to do this but I don’t think this is efficient or accurate.

This is because, there may be charges that hit your accounts for which you do not have a receipt.

You don’t want to miss charges for things like recurring expenses or subscriptions.

The best way to record your daily expenses is to actually log into your online accounts at the end of the day and write down any pending charges or hits to your checking account in your planner.

Just yesterday, this practice actually saved me some money.

We had actually subscribed to a channel that we no longer watch but forgot to cancel.

As I was recording my daily expenses, I saw this charge come through and immediately went to the service and cancelled it.

In Summary

Keeping track of your expenses does not have to be a complicated or high tech process.

A simple paper planner can get the job done.

Personally, I really like the weekly vertical layout in the

How Do You Keep Track of Expenses?

If you have a system that works well, I would love to hear about it! Leave me a comment below.

Happy budgeting!